Ai financial forecasting is revolutionizing the way businesses predict future financial performance. By leveraging sophisticated algorithms and machine learning techniques, AI can analyze vast datasets, identify intricate patterns, and generate highly accurate forecasts with unprecedented speed and efficiency. This transformative technology empowers businesses to make data-driven decisions, mitigate risks, and capitalize on emerging opportunities.

Enhanced Accuracy and Speed

Traditional financial forecasting methods often rely heavily on human intuition and manual data analysis, which can be time-consuming and prone to biases. AI financial forecasting overcomes these limitations by automating data processing and analysis. By analyzing historical data, market trends, economic indicators, and other relevant factors, AI algorithms can identify subtle patterns and relationships that may be imperceptible to human analysts. This enhanced accuracy and speed enable businesses to make more informed decisions with greater confidence.

Improved Risk Management

AI financial forecasting provides businesses with valuable insights into potential risks and uncertainties. By analyzing historical data and identifying potential threats, such as market volatility, credit risk, and operational disruptions, AI algorithms can help businesses proactively mitigate risks and develop contingency plans. This proactive approach to risk management can significantly reduce financial losses and enhance overall business resilience.

Enhanced Decision-Making

AI financial forecasting empowers businesses to make more informed and strategic decisions. By providing accurate and timely forecasts, AI enables businesses to:

- Optimize resource allocation: Allocate resources more effectively by accurately predicting future demand and resource needs.

- Improve pricing strategies: Optimize pricing models based on demand forecasts and competitor pricing.

- Enhance investment decisions: Make more informed investment decisions by accurately predicting future returns and risks.

- Improve cash flow management: Optimize cash flow by accurately predicting future cash inflows and outflows.

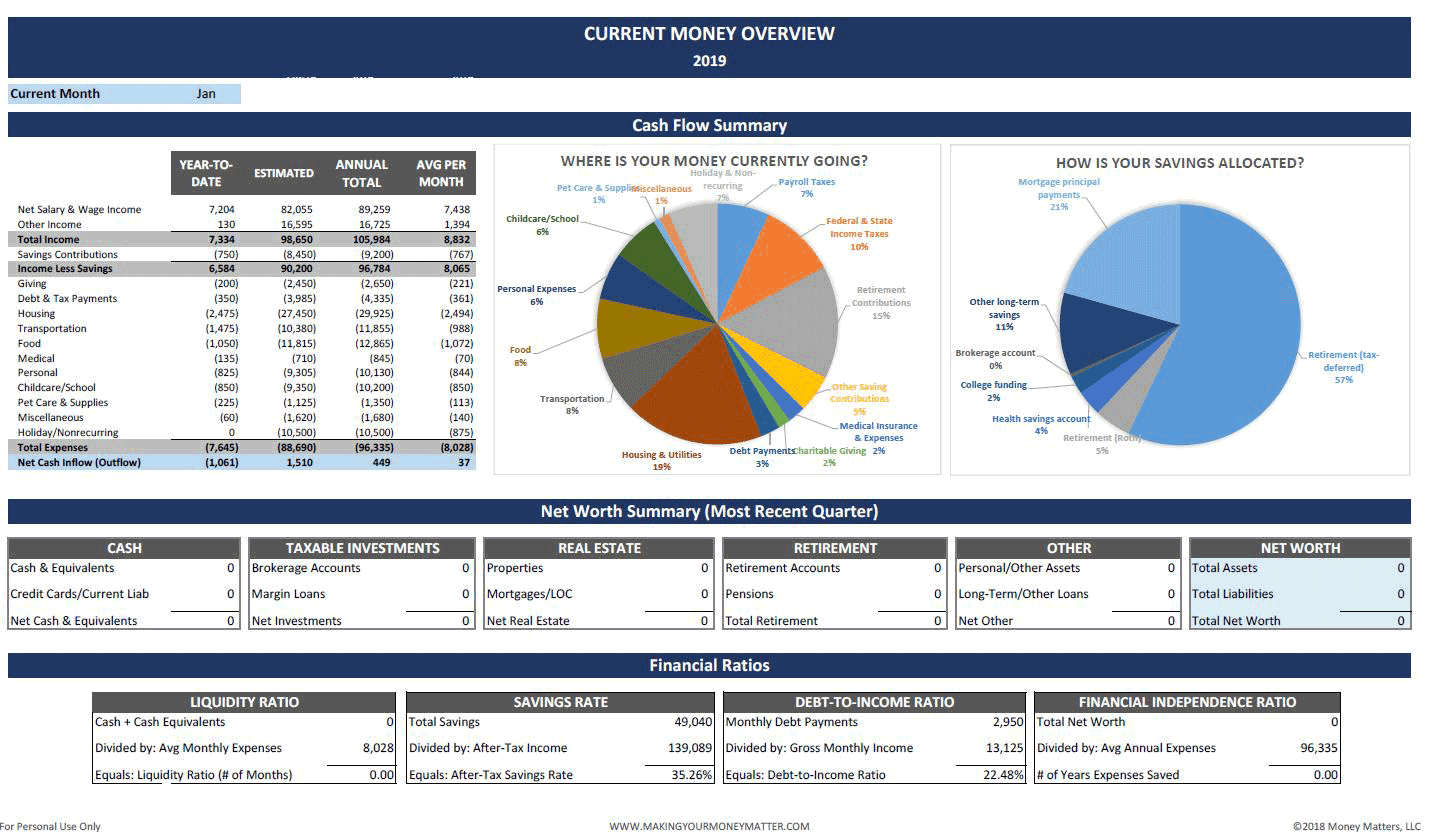

Personalized Financial Planning

AI financial forecasting is not limited to large corporations. Individuals can also leverage AI-powered tools to improve their personal financial planning. AI-driven financial advisors can provide personalized financial advice, such as portfolio optimization, retirement planning, and tax optimization, based on individual financial goals and risk tolerance.

The Future of AI Financial Forecasting

The field of AI financial forecasting is constantly evolving, with new technologies and techniques emerging rapidly. As AI continues to advance, we can expect even more sophisticated and powerful forecasting models that can provide businesses with even greater insights into the future.

- Explainable AI: One of the key challenges in AI financial forecasting is the “black box” problem, where it can be difficult to understand how AI algorithms arrive at their predictions. Explainable AI techniques are being developed to provide greater transparency and interpretability of AI-generated forecasts.

- Integration with other technologies: AI financial is increasingly being integrated with other emerging technologies, such as blockchain and the Internet of Things (IoT), to create even more powerful and insightful forecasting solutions.

- Increased adoption: As the benefits of AI financial become more widely recognized, we can expect to see increased adoption across a range of industries and applications.

Addressing the Challenges

While AI financial offers numerous benefits, it also presents certain challenges:

- Data quality and availability: The accuracy of AI-generated forecasts depends heavily on the quality and availability of data. Ensuring access to high-quality data and developing robust data management practices is crucial for successful AI implementation.

- Bias and fairness: AI algorithms can be susceptible to biases present in the training data. It is important to ensure that AI-based forecasting models are fair and unbiased, and that they do not perpetuate existing inequalities.

- Ethical considerations: The use of AI in financial forecasting raises important ethical considerations, such as data privacy, transparency, and accountability. It is crucial to develop and adhere to ethical guidelines for the responsible use of AI in finance.

:max_bytes(150000):strip_icc()/GettyImages-648879880-eee7d12512e04f7ab11cb3a75d537ae6.jpg)