Personal finance activities are essential for everyone, regardless of age or income. They help you manage your money effectively, make informed financial decisions, and achieve your financial goals.

What are Personal Finance Activities?

Personal finance activities are any actions you take to manage your money. This includes budgeting, saving, investing, and paying bills.

Why are Personal Finance Activities Important?

Personal finance activities are important because they help you:

- Make informed financial decisions

- Achieve your financial goals

- Reduce financial stress

- Build wealth

- Protect yourself from financial risks

How to Get Started with Personal Finance Activities

If you are not sure where to start with personal finance activities, here are a few tips:

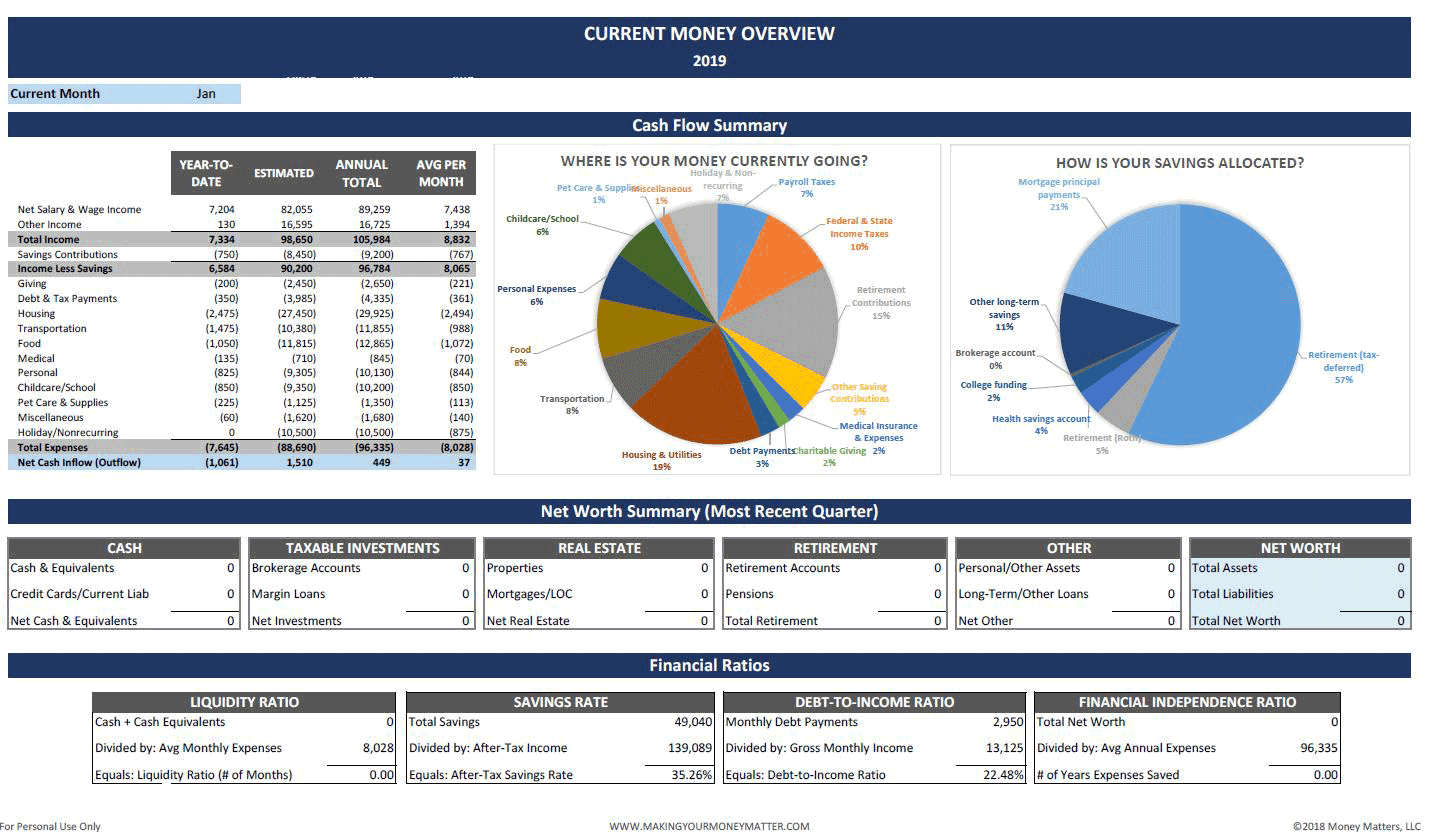

- Create a budget. A budget is a plan for how you will spend your money. It can help you track your income and expenses and make sure you are not overspending.

- Start saving. Even if you can only save a small amount of money each month, it is important to start saving early. The sooner you start saving, the more time your money will have to grow.

- Invest your money. Investing your money can help you grow your wealth over time. There are many different investment options available, so it is important to do your research and find the best option for you.

- Pay your bills on time. Paying your bills on time is important to avoid late fees and damage to your credit score.

- Protect yourself from financial risks. This includes things like purchasing insurance and creating an emergency fund.

Personal Finance Activities for Students

Students can also benefit from engaging in personal finance activities. Here are a few tips for students:

- Create a budget for your student expenses. This can help you track your income and expenses, and make sure you are not overspending.

- Start saving for your future. This could include saving for tuition, a down payment on a car, or a down payment on a house.

- Learn about investing. Investing your money can help you grow your wealth over time. There are many resources available to help students learn about investing.

- Pay your bills on time. This is important to avoid late fees and damage to your credit score.

- Get a part-time job. A part-time job can help you earn extra money and gain valuable work experience.

Personal Finance Activities for Adults

Adults can also benefit from engaging in personal finance. Here are a few tips for adults:

- Create a budget for your household expenses. This can help you track your income and expenses, and make sure you are not overspending.

- Start saving for retirement. The sooner you start saving for retirement, the more time your money will have to grow.

- Invest your money. Investing your money can help you grow your wealth over time. There are many different investment options available, so it is important to do your research and find the best option for you.

- Pay your bills on time. This is important to avoid late fees and damage to your credit score.

- Protect yourself from financial risks. This includes things like purchasing insurance and creating an emergency fund.

Personal Finance Activities for Seniors

Seniors can also benefit from engaging in personal finance activities. Here are a few tips for seniors:

- Review your budget and make adjustments as needed. Your expenses may change as you age, so it is important to review your budget regularly and make adjustments as needed.

- Make sure you have enough money saved for retirement. If you are not sure if you have enough money saved for retirement, you can talk to a financial advisor.

- Consider downsizing your home. If you are no longer able to maintain your current home, you may want to consider downsizing. This can help you reduce your expenses and free up some extra cash.

- Review your insurance policies. As you age, you may need to make changes to your insurance policies. For example, you may need to increase your coverage for health insurance or long-term care insurance.

- Stay informed about financial scams. Seniors are often targeted by financial scams. It is important to be aware of these scams and to take steps to protect yourself.

The Benefits of Engaging in Personal Finance Activities

Engaging in personal finance can have many benefits. It can help you:

- Make informed financial decisions

- Achieve your financial goals

- Reduce financial stress

- Build wealth

- Protect yourself from financial risks

By engaging in personal finance, you can take control of your finances and achieve your financial goals.

Personal Finance Activities and Technology

There are many online resources and tools available to help you with your personal finance. This includes budgeting apps, investment calculators, and credit monitoring tools.

Personal Finance Activity is an Ongoing Process

Personal finance activity is an ongoing process. It is important to review your finances regularly and make adjustments as needed. By making small changes to your habits, you can make a big difference in your financial health.

Personal Finance Activities are Essential for Everyone

Personal finance are essential for everyone, regardless of age or income. By engaging in personal finance , you can take control of your finances and achieve your financial goals.

:max_bytes(150000):strip_icc()/GettyImages-648879880-eee7d12512e04f7ab11cb3a75d537ae6.jpg)