In today’s complex financial world, taking control of your finances is more crucial than ever. While sophisticated financial software exists, a simple yet powerful tool like Excel can be surprisingly effective for personal financial planning. Financial planning excel offers a customizable and accessible platform to track income, expenses, set goals, and monitor progress towards achieving them.

Budgeting with Financial Planning Excel

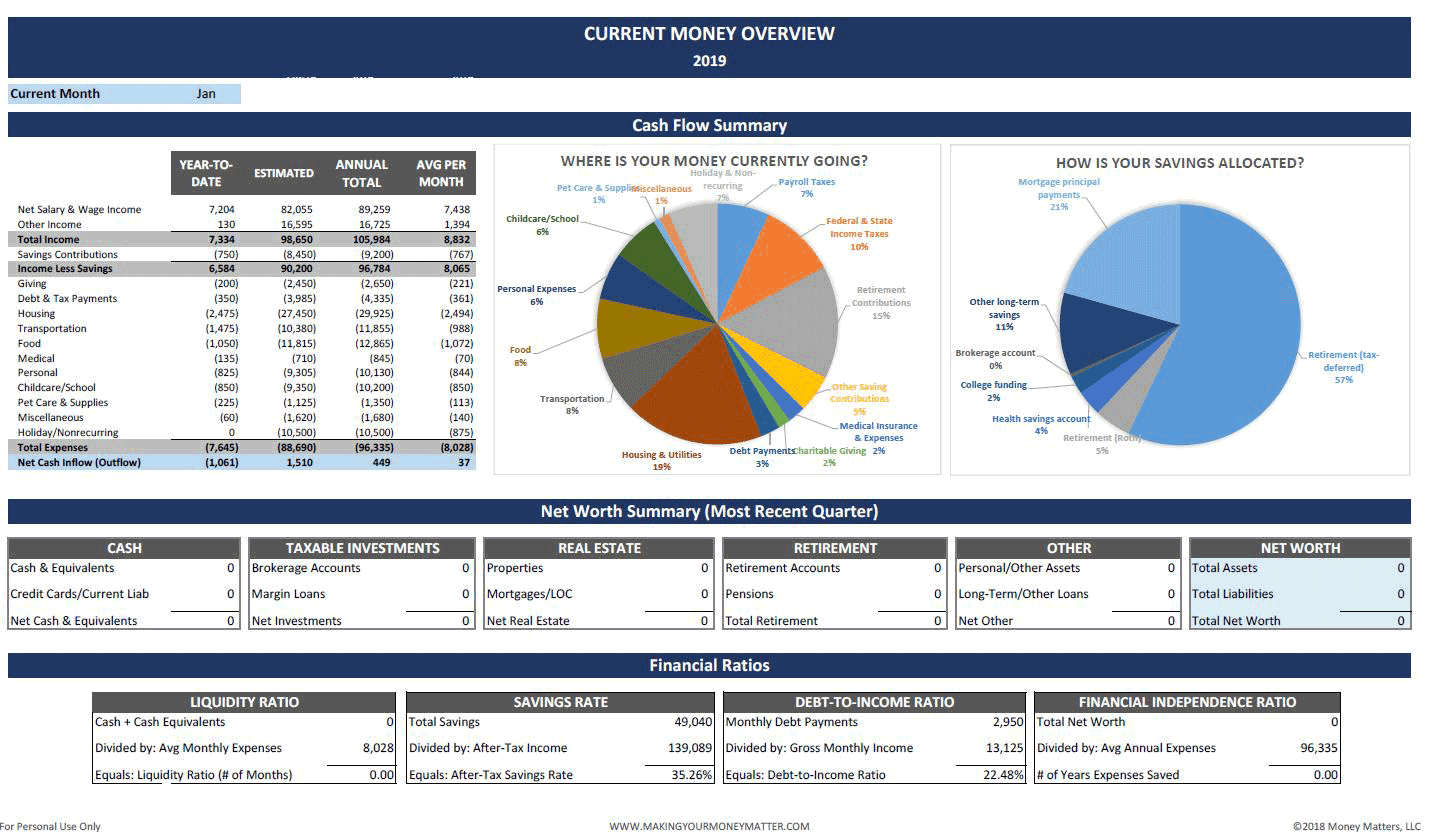

One of the most fundamental aspects of personal finance is budgeting. Financial planning excel excels in this area, allowing you to create detailed budgets that track income and expenses across various categories. You can input monthly income from various sources, categorize expenses (rent, utilities, groceries, entertainment, etc.), and easily track your spending habits. This visibility into your cash flow can help you identify areas where you can cut back and allocate funds more effectively.

Tracking Expenses with Financial Planning Excel

Beyond budgeting, financial planning is an invaluable tool for tracking expenses. By meticulously recording every expenditure, you gain a clear understanding of where your money is going. This detailed record can reveal hidden spending patterns, identify areas of overspending, and help you make informed decisions about your spending habits.

Setting and Achieving Financial Goals with Financial Planning Excel

Whether it’s saving for a down payment on a house, planning for retirement, or funding a child’s education, financial planning can help you set realistic financial goals and track your progress towards achieving them. You can create separate worksheets for each goal, input target amounts, and track your savings contributions over time. By visualizing your progress, you can stay motivated and make adjustments to your plan as needed.

Investing and Retirement Planning with Financial Planning Excel

Financial planning excel can also be used to model investment portfolios and plan for retirement. You can track the performance of different investment options, calculate potential returns, and adjust your investment strategy based on your risk tolerance and time horizon. By projecting future income and expenses, you can estimate your retirement needs and determine how much you need to save to achieve your desired retirement lifestyle.

Creating a Personalized Financial Dashboard

By utilizing Excel’s charting and data visualization features, you can create a personalized financial dashboard. This dashboard can provide a visual overview of your financial situation, including net worth, income and expenses, savings progress, and investment performance. This visual representation can help you quickly identify trends, make informed decisions, and stay on track towards your financial goals.

The Flexibility and Customization of Financial Planning Excel

One of the key advantages of using financial planning is its flexibility and customization. You can tailor your spreadsheets to your specific needs and preferences, adding or removing categories, adjusting formulas, and creating custom reports. This level of customization allows you to create a financial planning tool that perfectly suits your individual circumstances.

Beyond the Basics: Advanced Financial Modeling

While basic budgeting and tracking are fundamental, financial planning can also be used for more advanced financial modeling. You can create complex scenarios, such as “what-if” analyses, to explore the potential impact of different financial decisions. For example, you can model the impact of a salary increase, a change in interest rates, or a major life event on your overall financial situation.